B&N Editorial: Who Wants Some Good News?

By: Douglas B. Silver

Let’s admit it. We are barraged with bad news. Covid, inflation, China’s rare-earth monopoly, Russia’s aggressive expansion plans, January 6th, constitutional changes in Chile, and anti-mining NGOs. It’s amazing that we all aren’t dieting on valium. But I have some good news.

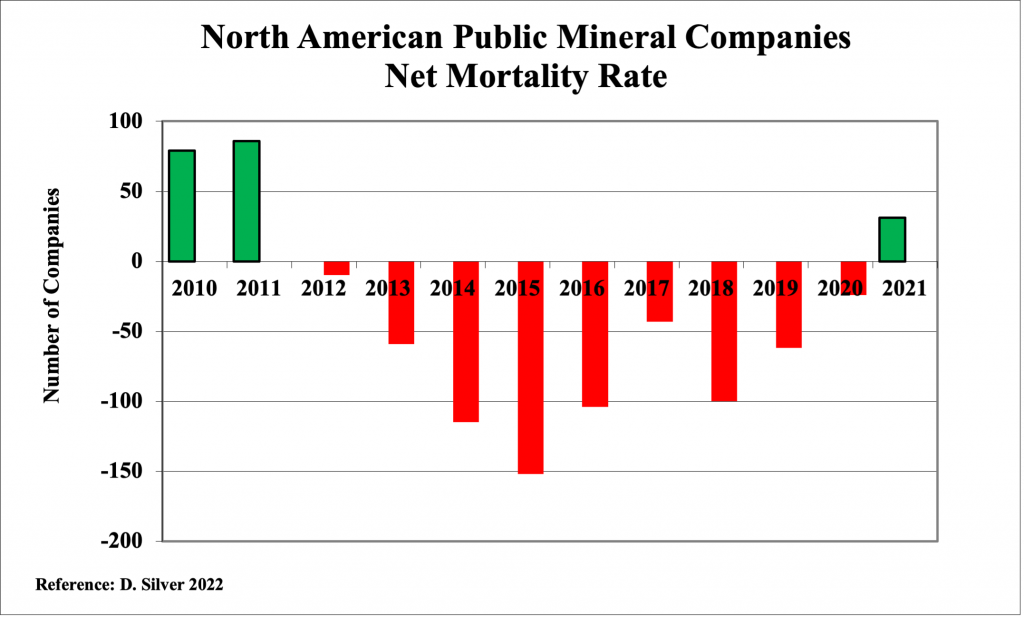

The North American capital markets represent more than 60% of the world’s public mineral companies, so studying this population can give us insights into the health of the global industry. For the past thirty years, I have tracked the births and deaths for more than 15,000 public North American mineral companies. If we net their number of births against their deaths, we get a net amount. When business is bad, more die than get born, resulting in a net loss of companies. When times are good, we see more births than deaths, and the industry expand.

As shown in the figure above, 2021 is the first year in a decade where we had a positive year. But look closer at the data. Since 2015, we have systematically had fewer net deaths. This suggests that the foundation of our industry has recovered from the last major recession, and is stronger and growing.

This trend reflects a combination of factors. On the birth side, we saw a number of companies immigrate from other industries into our business. My Canadian sources tell me that the cannabis industry is now so overregulated, that companies are returning to the minerals industry where the rules were set decades ago. Similarly, there was a 50% drop in the number of companies leaving our industry. This, no doubt, reflects the surge in many different commodity prices. It also appears that companies are able to raise funds again, which directly underpins their health.

Tie these facts back to my last column and this is additional proof that our world is improving. As the “green economy” unfolds, these trends should continue their upward trajectory. Metal price increases spurs new investors to come into our space. This, in turn, provides companies with new funding to explore, develop, mine and expand. Each of these activities takes a lot of people, so opportunities abound. The trick now is to capitalize on it. How are you taking advantage of our brave new world?